Financial Empowerment

Credit Build

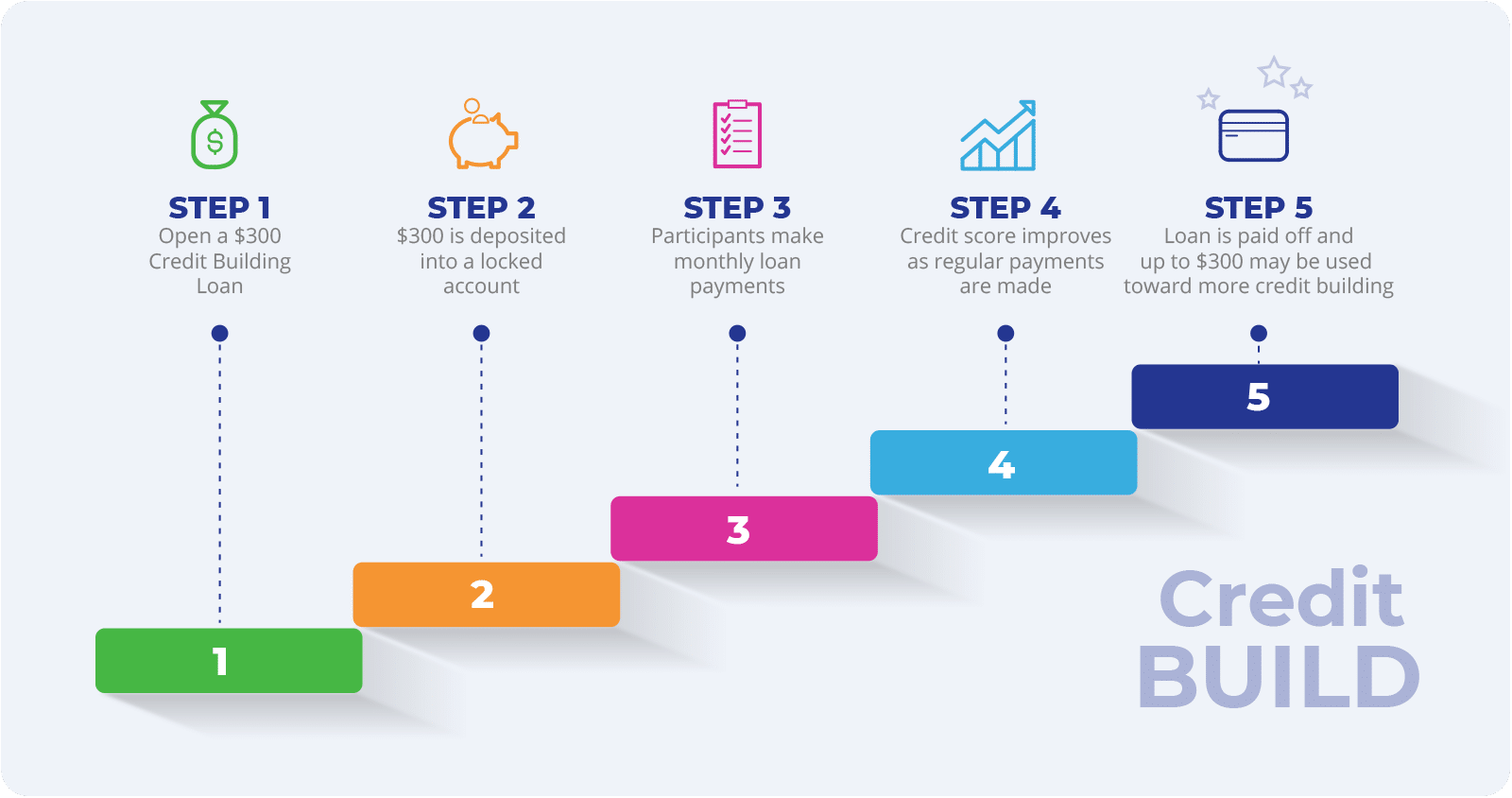

Credit Build helps young adults who have been in foster care establish and build credit through guided savings. Credit Build allows participants to save $300 while building their credit score. How?

- Foster Success works with national partners to open a $300 credit-building loan.

- Participants make 12 monthly payments of approximately $28 each month into a locked savings account.

- Each successful payment is reported to all three credit bureaus, increasing credit scores each month.

After the loan is paid off, the $300 is returned to you to continue building your financial wellness. We highly encourage you to pay down your debt, open a secured credit card, or build your savings.

Who is Credit Build for?

Anyone 18-25 who has lived in foster care in Indiana on or after their 14th birthday and:

- Has limited or no credit history and very few existing loans or debts.

- May previously have been denied loans or financial services.

- Demonstrates a willingness and readiness to save money and improve financial health.

- Has not had any foreclosures or late payments in the last 90 days.

- Demonstrates income or an ability to make the monthly payments.

What will I have to do?

Throughout the year-long program, you will meet with your financial coach 2-4 times. During these sessions, you will receive support in:

- Organizing and prioritizing paying down debt

- Monitoring and managing credit

- Assessing your current financial state and creating a budget

- Establishing financial goals

Questions? Contact Hannah Milner, Director of Health & Financial Well-Being

hannah@fostersuccess.org • 317-504-1503

All Financial Empowerment Programs

Online Financial Modules

Foster Success offers a series of online courses that will teach you about topics ranging from banking to insurance. You learn new skills, and you can also earn money when you pass all seven Online Financial Modules with a score of at least 80%.